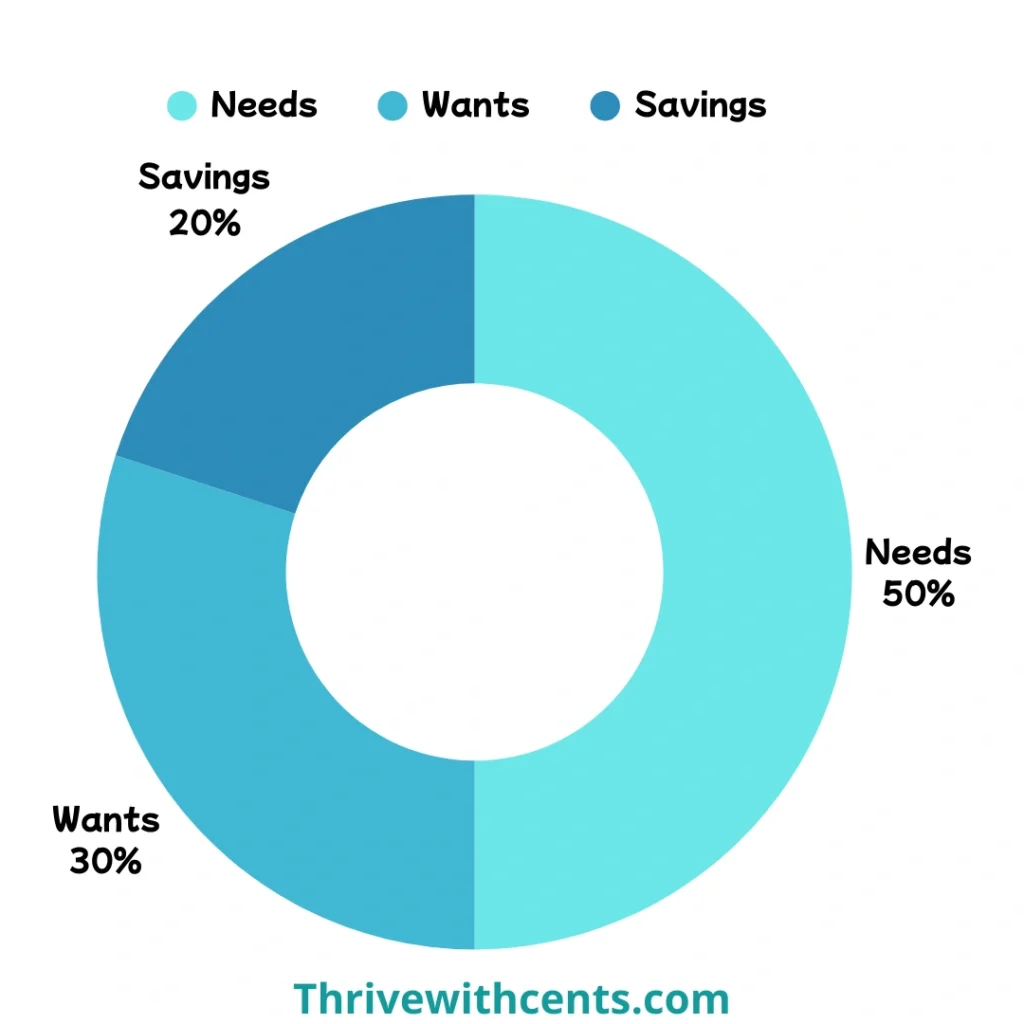

Take control of your money with this simple and effective budget calculator! Based on the popular 50/30/20 rule, this tool helps you divide your monthly income into three smart spending categories:

20% Savings – Savings, debt repayment, or investing in your future

50% Needs – Essentials like rent, groceries, utilities, insurance

30% Wants – Non-essentials like dining out, entertainment, shopping

50/30/20 Budget Calculator

If you’ve ever felt overwhelmed trying to create a monthly budget, you’re not alone. With so many categories, expenses, and financial advice floating around, it’s easy to get stuck. But there’s a powerful, proven method that simplifies everything: the 50/30/20 rule. And with our free 50/30/20 Budget Calculator below, you can put it into action in seconds.

What Is the 50/30/20 Rule?

Popularized by U.S. Senator and bankruptcy expert Elizabeth Warren, the 50/30/20 rule is a simple budgeting formula designed to help people manage their money more effectively. It divides your after-tax income into three clear spending categories:

- 50% for Needs: Essentials like rent, utilities, groceries, insurance, and transportation

- 30% for Wants: Non-essentials like entertainment, dining out, vacations, or subscriptions

- 20% for Savings and Debt Repayment: Emergency funds, investments, paying off loans or credit cards

This method isn’t just easy to understand—it’s also realistic and flexible for a variety of lifestyles and income levels.

Try the 50/30/20 Calculator

To make budgeting even easier, we’ve included a free, interactive calculator below. Just enter your monthly income, hit “Calculate,” and instantly see how much to allocate to each category. Whether you earn $2,000 or $10,000 a month, this tool gives you a personalized breakdown you can use immediately.

How to Use the Calculator

- Enter your monthly income into the calculator box.

- Click the "Calculate" button.

- Instantly view how much money should go toward:

- Needs (50%)

- Wants (30%)

- Savings & Debt (20%)

For example, if your income is $4,000 per month:

- $2,000 goes to Needs

- $1,200 goes to Wants

- $800 goes to Savings/Debt

This clarity helps you make informed choices—and gives every dollar a job.

Why the 50/30/20 Rule Works

The beauty of this rule is in its simplicity. Unlike complicated spreadsheets or rigid systems, this approach gives you flexibility while keeping you accountable. Here are a few key benefits:

- Reduces decision fatigue: With only three categories, you don’t have to micromanage every dollar.

- Fits any income level: Whether you’re a student, freelancer, or family breadwinner, this rule adapts to your earnings.

- Promotes healthy financial habits: By setting aside 20% for savings and debt repayment, you're building long-term stability.

- Prevents overspending: The 30% “wants” cap helps you enjoy life without going overboard.

Pro Tips to Maximize Your Budget

Here are a few simple ways to make the most of your 50/30/20 plan:

- Automate your savings: Set up automatic transfers to a savings account or retirement fund.

- Track your spending for a month: Use an app or a simple spreadsheet to compare your actual spending to the suggested breakdown.

- Adjust based on your goals: If you're aggressively paying off debt, consider a 60/20/20 or 50/20/30 split temporarily.

- Revisit your budget regularly: Life changes—so should your budget. Review it every few months or after major changes in income or expenses.

Final Thoughts

The 50/30/20 rule is a powerful tool that takes the guesswork out of budgeting. Whether you're just starting your financial journey or looking to simplify your current system, this method offers clarity, flexibility, and control.

With our free calculator, you don’t need spreadsheets or formulas—just your income and a minute of your time. Use it today and take the first step toward smarter money management!

7 thoughts on “50/30/20 Budget Calculator + Free Printable Worksheet”

Comments are closed.