Every financial journey starts with a single step. Mine began when I saw my paycheck vanish quickly. Like many, I didn’t know where my money went until I found the 50/30/20 rule. It changed my financial life.

This money management method breaks down complex planning into three easy parts. It helps you use your after-tax income wisely. This way, you can meet your current needs and plan for the future.

The 50/30/20 rule is more than just a trend. U.S. Senator Elizabeth Warren made it popular. It offers a clear, doable plan for anyone to manage their finances better.

Key Takeaways

- Learn a simple, effective budgeting strategy

- Understand how to allocate income wisely

- Create financial stability through structured spending

- Reduce financial stress with a clear plan

- Build long-term financial resilience

Understanding the Basics of Smart Money Management

Financial planning is more than just tracking numbers. It’s about creating a roadmap for your money. This roadmap helps you make smart choices and reach your goals. Learning to spend wisely is a skill you can develop over time.

Effective budgeting changes how you view money. Your financial discipline helps you handle tough times and build wealth for the future. Let’s look at what makes financial management successful.

What Makes a Budget Effective

A good budget does more than just add and subtract numbers. It should:

- Reflect your personal financial goals

- Provide flexibility for unexpected expenses

- Balance current needs with future aspirations

- Create clear spending boundaries

The Psychology of Financial Planning

Your mindset is key to financial success. Emotional intelligence about money helps you make smart choices. It keeps you from buying on impulse and keeps you focused on your goals.

Building Financial Discipline

Building financial discipline takes effort. Start by:

- Setting realistic financial goals

- Tracking your spending meticulously

- Creating accountability mechanisms

- Rewarding yourself for financial milestones

Remember, mastering smart money management takes time and effort. Your financial journey starts with understanding these basic principles.

💰 Try Our Free 50/30/20 Budget Calculator

Take control of your money the smart way. Use our free calculator to break your income into Needs (50%), Wants (30%), and Savings (20%).

👉 Use the Calculator NowThe 50/30/20 Rule: Breaking Down the Framework

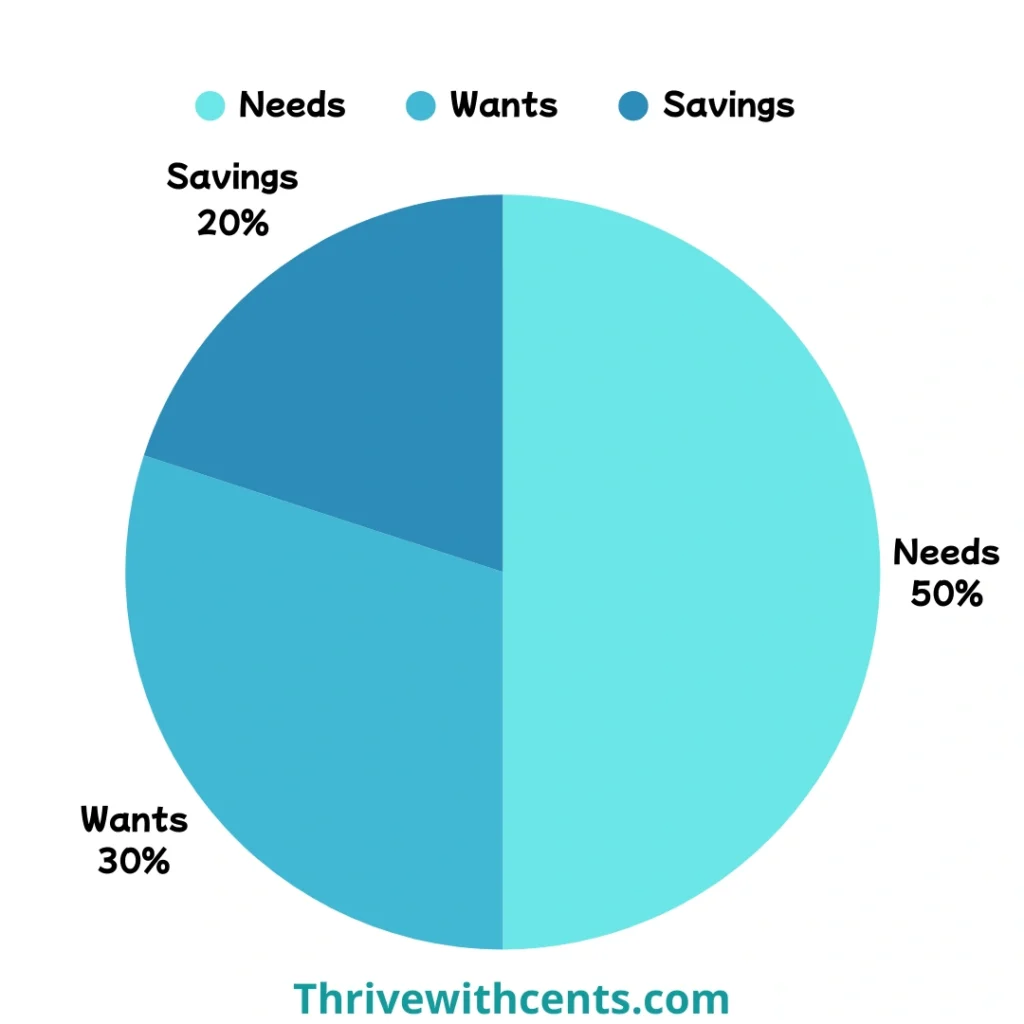

The 50/30/20 rule makes budgeting easy. It divides your after-tax income into three parts. This helps you balance saving and spending.

This rule focuses on three main areas:

- 50% for Needs: Essential costs for living

- 30% for Wants: Money for fun and personal treats

- 20% for Savings: For your future and emergencies

This method helps you plan a budget that covers now and later. It’s simple and can be adjusted to fit your life.

| Category | Percentage | Purpose |

|---|---|---|

| Needs | 50% | Housing, utilities, groceries, insurance |

| Wants | 30% | Entertainment, dining out, hobbies |

| Savings | 20% | Emergency fund, retirement, investments |

You don’t have to stick to the 50/30/20 rule exactly. It’s a guide to help you manage your money. By watching your spending and saving, you’ll control your finances better.

Essential Expenses: Managing Your 50% Needs

Managing your essential expenses is key to smart spending. The 50/30/20 rule says to spend 50% of your income on must-haves. This helps you focus on what you really need for survival and a good life.

Planning your essential expenses needs careful thought. You should aim to cover basic needs while looking for ways to save.

Housing and Utilities: Your Financial Foundation

Housing is usually the biggest expense. It’s wise to keep housing costs at 25-35% of your income. This includes:

- Rent or mortgage payments

- Property taxes

- Basic utilities (electricity, water, heating)

- Essential home maintenance

Healthcare and Insurance: Protecting Your Well-being

Healthcare is a must. Good budgeting for health should include:

- Health insurance premiums

- Regular medical check-ups

- Prescription medications

- Emergency medical fund

Transportation and Basic Food: Staying Mobile and Nourished

Transportation and food are basic needs that need smart budgeting. Here are some tips:

- Economical transportation options

- Grocery shopping with a planned budget

- Meal planning to reduce food waste

- Using public transit or carpooling

Remember, the goal is not just to spend, but to spend wisely on what truly matters for your survival and basic comfort.

Discretionary Spending: The 30% Wants Category

Smart spending habits mean knowing the difference between needs and wants. The 30% wants category in your budget lets you enjoy life while staying financially disciplined. It’s about personal choices that make your life better without hurting your finances.

Expenses in the wants category include things like entertainment, dining out, and hobbies. Think of wants as the experiences and items that bring joy but aren’t strictly necessary for survival.

- Streaming services

- Restaurant meals

- Concert tickets

- Weekend getaways

- Technology upgrades

Smart spending in this category needs careful planning. Here are some tips for managing your discretionary expenses:

- Prioritize experiences that genuinely make you happy

- Look for cost-effective alternatives

- Set clear spending limits

- Regularly review and adjust your wants budget

Your wants budget isn’t about cutting back—it’s about spending wisely. By allocating funds to discretionary expenses, you find a balance. This balance supports both financial responsibility and personal enjoyment.

Building Wealth: Maximizing Your 20% Savings

When you save 20% of your income, you hit a big milestone. This move turns saving into a way to achieve financial freedom. It’s not just about saving money. It’s about growing your wealth over time to reach your goals.

Emergency Fund Creation

Building a strong emergency fund is key to good financial planning. Try to save three to six months of living costs in a place you can quickly get to. This fund helps you deal with sudden money problems like losing your job or big medical bills.

- Start with $1,000 as an initial emergency buffer

- Gradually increase savings to cover 3-6 months of expenses

- Keep emergency funds in high-yield savings accounts

Retirement Planning

Retirement savings are vital for building wealth over the long term. Use accounts like 401(k) and IRA to get tax benefits and grow your money. Don’t miss out on employer matches to boost your savings.

Debt Reduction Strategies

Reducing debt quickly helps you build wealth faster. Focus on high-interest debts while keeping up with savings. Use methods like the debt avalanche to pay off debts one by one.

- List all debts from highest to lowest interest rate

- Make minimum payments on all debts

- Apply extra funds to highest-interest debt first

By saving 20% of your income for these smart financial moves, you’ll set up a strong plan for wealth and security in the future.

Implementation Strategies for Budget Success

Changing how you manage money needs a solid plan. The 50/30/20 budget rule is a great start. But, it takes regular effort and smart moves to succeed.

First, pick the right tools for tracking your budget. Digital apps and spreadsheets make it easier to keep track of expenses. Here are some top choices:

- Budgeting mobile apps with automatic expense categorization

- Spreadsheet templates with built-in calculation formulas

- Bank account tracking features

- Personal finance management platforms

Automation is your friend in finance. Set up automatic transfers for savings and bills. This saves time and helps avoid mistakes.

| Budget Tracking Method | Pros | Effort Required |

|---|---|---|

| Mobile Apps | Real-time tracking | Low |

| Spreadsheets | Customizable | Medium |

| Manual Tracking | Complete control | High |

Success in budgeting comes from staying disciplined. Regularly check your spending, tweak categories when needed, and stick to your financial goals. Small steps lead to big changes over time.

Remember, getting better at budgeting takes time. Be kind to yourself and celebrate small wins on your financial path.

Common Challenges and How to Overcome Them

Starting a budget isn’t always easy. It takes commitment and being open to change. The 50/30/20 rule is a good start, but real-life problems can make it tough.

Navigating Income Fluctuations

Changes in income can mess up your budget. Whether you get a raise or face a cut, being flexible is crucial. Here are some tips:

- Create a flexible savings buffer to handle income changes

- Keep checking and tweaking your budget percentages

- Look into different ways to make money for more stability

Managing Unexpected Expenses

Life is full of surprises that can upset your budget. Medical bills, car fixes, or home upkeep can throw you off track. Here’s how to stay ahead:

- Build a strong emergency fund

- Focus on what’s really important

- Find ways to cut costs temporarily

Sustaining Long-Term Motivation

Staying disciplined with money takes mental strength. Set achievable goals, track your progress, and celebrate small wins. Remember, budgeting is about gaining freedom and peace of mind, not just cutting back.

Your financial journey is unique. Be patient, stay flexible, and keep your eyes on the long-term financial goals.

Tools and Resources for Budget Tracking

Mastering money management is now easier with the right digital tools. Thanks to new technologies, budgeting is no longer a complex task. It’s made simple for everyone.

Many powerful apps can help you track your 50/30/20 budget accurately. Apps like Mint, YNAB (You Need A Budget), and PocketGuard offer great features. They make it easy to keep an eye on your expenses:

- Automatic expense categorization

- Real-time spending alerts

- Customizable budget dashboards

- Goal tracking capabilities

If you prefer spreadsheets, Google Sheets and Microsoft Excel have free templates. These tools let you create your own budget trackers. You can make them fit the 50/30/20 rule perfectly.

For deeper insights, online budget calculators are a game-changer. They help you:

- Calculate potential savings

- Analyze spending patterns

- Forecast financial goals

- Identify areas for potential cost-cutting

Pro tip: Mix and match different tools to build a financial planning system that suits you.

Conclusion

The 50/30/20 budgeting strategy is a powerful tool for managing your money. It helps you divide your income into three main parts. This makes it easier to achieve financial stability and grow your wealth over time.

Starting your financial journey is simple with this strategy. It lets you focus on what’s important, enjoy some spending, and save for the future. This rule is flexible, fitting your unique financial needs.

Learning to manage your money takes time. Begin with small steps, track your progress, and stay focused on your goals. The 50/30/20 rule is more than a budgeting method. It’s a way to take charge of your finances, reduce stress, and open up new economic opportunities.

Improving your financial health is possible. By using this strategy, you’ll become more disciplined, resilient, and ready to achieve your financial dreams. Start today and see your confidence in handling money grow.

2 thoughts on “The 50/30/20 Rule: A Simple Guide to Budgeting”

Comments are closed.